portability estate tax return

The return is due nine months after death with a six-month. For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

To obtain a portability election extension they can file a complete Form 706 by January 2 2018 or the second anniversary of the decedents death whichever is later.

. For 2022 the exemption has been adjusted for inflation to 1206 million per taxpayer and 2412 million per married couple. Any estate that is filing an estate tax return only to elect portability and did not file timely or within the extension provided in Rev. Portability has been part of the law since late in 2010.

In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the. To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return. Until 2012 portability was part of a law that had been set to sunset.

In other words it could not be relied upon. Portability and estate tax exceptions may be tricky. 2017-34 to elect portability under Sec.

Portability is the ability for the surviving spouse to use the deceased spouses unused estate and gift tax exclusion after the deceased spouses death. 2017-34 extends the time under certain circumstances to file an estate tax return to make a portability election. The IRS has recently revised the instructions to Form 706 United States Estate and Generation-Skipping Transfer Tax Return.

6018 a with a due date of nine months after the decedents death or the last day of any period covered by an extension obtained under Regs. For example if Bob and Sally are married and Bob dies in 2011 and only uses 3000000 of his 5000000 federal estate tax exemption then Sally can elect to pick up Bobs unused 2000000 exemption and add it to her estate tax exemption. They provided guidance for electing Portability.

2010 - 2 a 1 estates electing portability are considered to be required to file Form 706 under Sec. Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. Proc 2017-34 issued in part due to the considerable number of.

Since the value of the estate is below the exclusion amount an estate tax return would not normally have to be filed a short form was proposed for those taxpayers who are only filing to satisfy portability requirements but the IRS recently rejected the idea citing the need for accuracy. The rules for missed elections go down. To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death.

If the filing threshold has not been met in other words. When filing the taxes its important to select the portability election to have the benefits transferred to. If the estate needs more time to file for portability they can apply for a 6-month extension.

2017-34 any estate of a decedent who passed away after December 31st of 2010 is automatically granted an extension until January 2nd of 2018 to file the Form 706 estate tax return to claim portability. Specifically under Section 401 1 of Rev. 2010 c 5 a.

Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. A Election required for portability. In addition going forward any executor will automatically have until the second.

The election to transfer a DSUE amount to a surviving spouse is known as the portability election. 6075 - 1 and 20. On top of this generous amount the IRS also allows for portability of the exemption between.

2017-34 may seek relief under Regulations section 3019100-3 to make the portability election. The estate tax return must include a note at the top stating that it is filed pursuant to Rev. The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for.

An estate tax return also must be filed if the estate elects to transfer any deceased spousal unused exclusion DSUE amount to a surviving spouse regardless of the size of the gross estate or amount of adjusted taxable gifts. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can. The TCJA doubled the estate and gift tax lifetime exemption from 549 million per taxpayer to 1118 million per taxpayer.

The instructions also cover the executors ability to use a checkbox to opt-out of electing Portability of the unused exclusion amount. Please note these laws being permanent means that they are not set. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021.

Assuming that Sally has not used any of her estate tax exemption for lifetime gifts. To allow a decedents surviving spouse to take into account that decedents deceased spousal unused exclusion DSUE amount the executor of the decedents estate must elect portability of the DSUE amount on a timely filed Form 706 United States Estate and Generation-Skipping Transfer Tax Return estate tax return. But for the need to make the portability election the estate would not be required to file an estate tax return Revenue Procedure 2017-34 PDF provides a simplified method for certain taxpayers to obtain an extension of time to make the portability election under 2010c5A of the Internal Revenue Code.

Exploring The Estate Tax Part 2 Journal Of Accountancy

Table Of Contents Art Of The Estate Tax Return

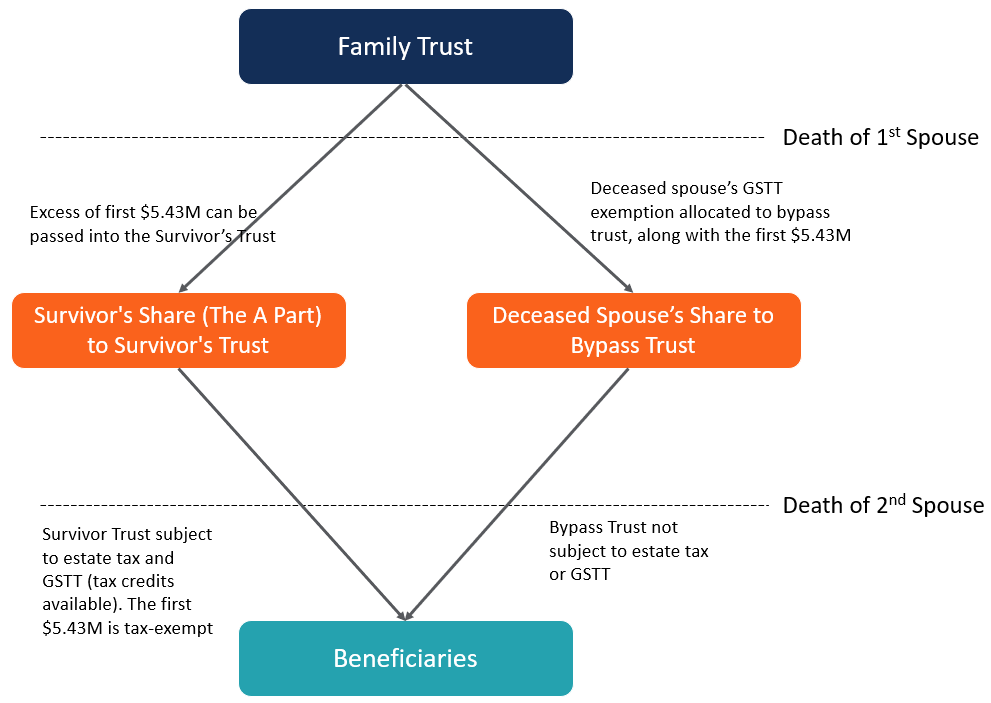

Bypassing The Bypass Trust With Permanent Portability

Form 706 Extension For Portability Under Rev Proc 2017 34

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

A B Trust Overview Purpose How It Works Advantages

Estate Tax Introduction Video Taxes Khan Academy

Deceased Spousal Unused Exclusion Dsue Portability

Preparing Form 706 The Federal Estate Tax Return Youtube

Form 706 Extension For Portability Under Rev Proc 2017 34

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Form 706 Extension For Portability Under Rev Proc 2017 34

Why Estate Tax Changes Mean More Families Will Have To Pay Youtube

Portability In Estate Tax Exemptions

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Your Beloved Spouse Just Died How To Deal With The Estate Tax